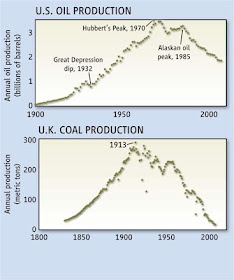

The Hubbert curve was introduced by, Hubbert, M. King. It predicts that production of any natural resource will follow a bell shaped curve, a reasonable idea. The background is that the yield individual exploitable deposits ranges from a little bit in very rich digs to a lot in poor ones. At first before demand has grown, the rich deposits are mined, as demand grows, the more common medium size lodes are mined, but we get better at it so the net production increases until finally only the really lean stuff is left and production falls as the cost per unit soars. The result is that production as a function of time follows a bell shaped curve. The idea took off when Hubbert predicted the peak production of oil in the US.

The Hubbert curve was introduced by, Hubbert, M. King. It predicts that production of any natural resource will follow a bell shaped curve, a reasonable idea. The background is that the yield individual exploitable deposits ranges from a little bit in very rich digs to a lot in poor ones. At first before demand has grown, the rich deposits are mined, as demand grows, the more common medium size lodes are mined, but we get better at it so the net production increases until finally only the really lean stuff is left and production falls as the cost per unit soars. The result is that production as a function of time follows a bell shaped curve. The idea took off when Hubbert predicted the peak production of oil in the US.Richard Kerr in Science discusses Ol' King Hubbert's coal curve. The general way of estimating coal is to try and gauge the amount from exploration. Lots of holes have been dug and geologists think they have a good idea of what is underneath. If you do this, you get estimates of 100+ years of reserves and a lot of CO2 pumped into the air during combustion. These estimates have been declining sharply in recent years as the rock jocks get serious. David Rutledge has been looking at the estimates for coal reserves and finds them to be systematically overestimated. He quotes Kenneth Deffeyess

When USGS workers tried to estimate resources, they acted, well, like bureaucrats. Whenever a judgment call was made about choosing a statistical method, the USGS almost invariably tended to pick the one that gave the higher estimate.”Rutledge estimates that 90% of coal reserves will be gone by 2070 (he says 2069, but that is engineer speak). Other groups put peak coal at 2020. In any case what is left after 2070 is gonna not be very good. You can, if you try hard enough burn dirt, which is what the Germans do with brown coal.

First the good news, if coal reserves are a factor of four or less than estimated, burning coal will bring us into a dangerous area, 3 C higher temperatures, but not necessarily a disastrous one.

The other news is, as Rutledge says, we have to start shifting energy sources right now in order to deal with the loss of fossil fuel sources as well as climate change

The bad news is tar sands and shale.

Eli is a cheery bunny, but you knew that

Minor nit: I think Hubbert really proposed this for oil, but people have certainly applied successfully it to other non-renewable resources. There are some particular features of petroleum geology that make it apply fairly well even to individual oil fields, that perhaps don't work so well for mines.

ReplyDeleteIt is a (bell-shaped, but not Gaussian) logistic curve.

From last Fall's ASPO in Sacramento, I recommend:

David Hughes presentation on coal , for many useful charts. He references Rutledge on occasion.

This meshes with Ayres & Warr's concerns about a big chunk of GDP depending on:

work = energy * efficiency

See the last page of 2005 PPT or paper&PDF.

One way or another, fossil fuels are mostly over within a century. To calibrate that, my favorite chart is Charlie Hall's Balloon Chart.

Just as King Hubbert's remarkably accurate estimation of US peak oil was rejected [it was ridiculed by those who thought they knew], in favour of the much larger but incorrect estimate from the USGS, Louis XV conclude that The new map of France, drawn after longitude had been accurately computed, that the cartographers lost more territory than his wars of conquest gained.

ReplyDeleteUnfortunately, there seems to be a natural unwillingness to believe data that are inconvenient [inconvenient truths?]

Politicians should take heed of the lessons taught by history!

JM,

ReplyDeleteThanks for the David Hughes presentation on coal.

It really is a must-read for anyone who thought they understood how deep we are the brown-stuff! My initial assessment is that things are worse than I thought.

I think we are deep in the brown-stuff. Estimates vary, but somewhere between neck-height and in over our heads and the level is still rising fast and yet we still have no realistic 'get out of jail' card to play. clean-coal / CCS is just a 'wait and see' ploy, which is of no practical use because of the rapidly worsening situation regarding: climate change; food supply; energy security; biosphere degradation; population; and maintaining a technological civilization that can keep us comfortable and has the ability to detect and solve problems.

It's just that our society's nervous system is so lethargic that as a species we haven't noticed! We might even be dead, but don't know it yet.

Oh mate, the recent history of UK coal is hardly what you'd call a data series untainted by exogenous political intervention.

ReplyDeleteIIRC, Stoat sez Hansen sez if we burn every fossil fuel possible then we get the real greenhouse effect. Not the piddly stuff that Romm talks about, but Venus-style.

ReplyDeleteMaybe this would change that calculation about our ability to truly screw things up.

that's the good news, but not if we burn shale and tar sands.

ReplyDeleteI worry about tar sands, but living in the West, I have reason to doubt the Green River tar sands will ever see much serious development, due marginal EROEI, but worse, water issues.

ReplyDeleteSee comments at Brave New Climate.

I said this elsewhere. It's modified here:

ReplyDeleteI'm not convinced.

Hubbert's method was sort of good for conventional oil but not nearly as good as it's portrayed to be. Peak-oil theorists use US production charts to show how prescient Hubbert was with US production topping out in the early 1970s, but those production charts almost always neglect to include Alaska north-slope oil (a correct version of the chart is one our rabbett overlord has posted), which ended up helping to create a second peak of US oil production around 1985 almost as big as the original peak. This was something that Hubbert's model did not predict. This is important because, back when Hubbert made the prediction, Alaska represented a frontier area and it was, as far as I know, still part of the United States. Well, those frontier areas still exist in the world today, not nearly as numerous, but there are places where discoveries can be made that weren't really being considered back then because of significant technological advances (eg. sub-salt plays, deepwater plays on the continental slope, the Arctic, etc...).

Let's not forget to mention that Hubbert's US prediction of a peak in the early 1970s was also his high (optimistic) case and, with Alaska, it still wasn't nearly enough to estimate future US oil production.

Hubbert's method hasn't considered unconventional oil either (like the oil sands of Canada, Venezuela, and I think there are some in Russia; and let's not forget Bakken Formation oil and others). And then there's enhanced recovery techniques, which are doing very well at taking geriatric oil (like the Ghawar field of Saudi Arabia and elsewhere) and squeezing every drop of oil out of it.

Hubbert's methodology has been terrible at assessing natural gas thanks to additions of unconventional gas. First there was tight gas, now there's shale gas, which has caused huge growth in US gas production (7.5% in 2008 alone and the market is now glutted) and just last summer there was the first, sustained, steady production test from gas hydrates in the Canadian Arctic (the second production test ever tried and they got steady rates and pressures; it's pretty impressive). All of this is thanks to technological leaps.

For coal, it's early, but there's still the good possibility of alternative methods of extraction of deep coal seams (like gasification), which is being done around the world. It's not mining per se, but it's turning coal resources into burnable energy. And, like much of the above, it's technology taking something unthought of and making energy as long as the price is right. I'd recommend not using "return on energy investment" to determine what's feasible, because a cheap, abundant form of energy can be used to create a fuel with a premium price and even if it takes a deficit of energy to do so, as long as a profit can be made, industry will do it.

So, Hubbert's methodology hasn't worked all that well for other resources in determining grand-scheme production trends. Therefore, I'm not sure how much we can trust it to model coal production accurately. I hope I don't create a flamewar by staying that. Hubbert made a very neat, superficially correct, but contextually wrong prediction, and that's a fact. And, because Hubbert's estimates can easily underestimate resources, therefore there's a very good possibility that there are plenty of fossil fuels in the world we can use to mess our climate up.

I will also say that carbon injection technology for CCS is very feasible: the oil patch in western Canada has been injecting sour gas into deep reservoirs for decades. They use CO2 to enhance oil recoveries out of the Weyburn oil pool in Saskatchewan. Some CO2-rich natural gas in British Columbia in a major new shale-gas field is going to have the CO2 stripped from it and injected in some formations deep underground starting in 2011. We're not talking small scale either: by around 2015, 3 million metric tonnes annually from this shale-gas field will be stored. With existing technology. Of course, not every place has access to reservoirs where CO2 can be stored, but, if you've got the reservoir, it shouldn't be written off.

WRT CCS, the hard thing is capturing the CO2 from the exhaust stream of coal-burning plants, but it's not that hard in oxy-fuel or other high efficiency systems where the exhaust stream is pure enough. If there's ever a carbon price,these systems might be able to compete with non-CCS coal burning plant because of the additional revenue. It's not that I'm a huge booster of CCS (plenty of methane can escape just from the mining), but I'm not willing to write it off just yet. It's a potential wedge but it will never be a silver bullet and should never be portrayed as such.

ended up helping to create a second peak of US oil production around 1985 almost as big as the original peak. This was something that Hubbert's model did not predict."

ReplyDeletedidn't change the overall shape much, though.

the alaskan subpeak is essentially noise superimposed on the main bell-shaped curve.

even the supply of oil in ANWR would not change things much.

Hubbert's predictions came out in 1956, AK became a state in 1958, but that's irrelevant given that Hubbert was explicitly modeling production only in the Lower-48, and he was right.

ReplyDeleteAny discussion that doesn't consider EROEI is missing a key piece.

Miguelito really should try his comments at TheOilDrum, where there are many more experts in this turf.

Meanwhile, I have two friends who certainly think Peak Oil is here or coming on next few years, and that we'd better be working very hard on efficiency and the long road to sustainable energy. I listen, since one of them was Chairman of Shell and the other Vice-Chair of Chevron, so possibly their opinions carry weight.

Separately, the WSJ had a useful story today by Stephanie Simon "Oil, Water are volatile mix in West"

about oil co's buying water rights.

Actually, even if they never do serious shale oil, water rights ate probably a dandy investment.

Recommendation: Cadillac Desert, especially for those unfamiliar with water and the US West.

"Hubbert's predictions came out in 1956, AK became a state in 1958, but that's irrelevant given that Hubbert was explicitly modeling production only in the Lower-48, and he was right.

ReplyDeleteAny discussion that doesn't consider EROEI is missing a key piece.

Miguelito really should try his comments at TheOilDrum, where there are many more experts in this turf."

Hubbert was only modeling the lower-48 because there was almost no production data from Alaska to model. It wasn't a choice, but a limitation of the data as brought about by a lack of technology. Which is one of my major points: frontier areas generate new finds and Alaska was part of the United States (it being a territory doesn't matter). It was land to explore, but the north-slope was really beyond their technical capabilities at the time so they couldn't. If they had been able to, they would have punched plenty of holes in it looking for more oil by the time Hubbert did his study.

Fact of the matter was that Hubbert's high-case scenario (I can't emphasize this enough, not medium case but high case) was still not enough to predict US production trends when Alaska is included. It was sort of close (instead of a peak in the early 70s, the smoothed peak sits in the late 70s) but still significantly underestimated.

And Hubbert's method has been terrible at projecting natural gas supplies. In fact, with the rising natural gas supplies come increasing natural gas liquids supplies, and the liquids take take a load off of oil supplies so oil can be used for other things.

And EROEI doesn't matter. There's not a single exploration company I know of that uses EROEI to make business decisions. It's about dollars and cents (of which energy is a cost, but not the only cost) and that's what determines production. Cheap energy can be used to make expensive energy, which can be sold for a profit. With the monstrous new reserves of shale gas coming, it makes oil shales far more viable. Gas prices are getting ridiculously low right now because the market is oversupplied and there's still plenty of gas that can come online when exploration companies start drilling again plus big LNG possibilities around the world. It makes the tar sands of Alberta far more viable (plenty of naysayers said those would never come online, but here we are, with them producing 3.3 million barrels per day with potential to go much higher).

And I don't have to go to the Oil Drum to speak to experts on hydrocarbon supply when I work with a bunch every day. I read reports on this kind of thing all the time. I work with an agency that does projections like this. We're not EIA or CERA and make very optimistic projections (I personally think overoptimistic just as much as Hubble's and Deffeye's estimates are pessimistic), but if we used Hubbert's methodology we'd be wrong, wrong, wrong. There's no room for the unconventional, enhanced recovery, and technological advances.

I'm not saying that we're never going to run out of oil. Far from it. I think we'll plateau around 2018 or so because fast-flowing oil is quickly being replaced by slow-flowing oil (because low-permeability reservoirs are replacing high-permeability reservoirs or because reservoirs that take a long time to bring on stream, like continental slope oil off of Brazil, are going to become increasingly common).

I'll also say that I'm not fond of using oil shale to generate oil (it's an environmental disaster in the making). I'm just trying to say that there's enough energy accessible right now and in the future to do ourselves in with greenhouse gases if we want to.

Just to make Eli really cheery, I'll remind him there is (maybe just was) some seriors research or dredginup up methyl caltrates.

ReplyDeleteSo we could really muck up the climate by burning lots of those.

Taht! to your piddly Alberta tar sands!

It is really embarrassing to lose your own comment on your own blog, but Eli managed to do this with an earlier reply to Miguelito. It went something like this:

ReplyDeleteThe bunny believes in the Hubbert curve because if you graph the cost of extraction of a resource vs. the amount available to be gotten at that cost, there is an exponential fall off (Sci Am article from the 60s, with what looked like good data, otoh, Eli could see in those days). Thus at some point you hit diminishing returns where it doesn't pay to go get it.

There is a double bind with energy, not only is the cost for the last bits high, but if the energy cost of extraction exceeds the energy gotten by extracting the fuels, why bother.

Shale is pretty close to that point

"The bunny believes in the Hubbert curve because if you graph the cost of extraction of a resource vs. the amount available to be gotten at that cost, there is an exponential fall off (Sci Am article from the 60s, with what looked like good data, otoh, Eli could see in those days). Thus at some point you hit diminishing returns where it doesn't pay to go get it.

ReplyDeleteThere is a double bind with energy, not only is the cost for the last bits high, but if the energy cost of extraction exceeds the energy gotten by extracting the fuels, why bother."

Costs come down as technology improves and makes the uneconomic very economic. Shale gas ten years ago couldn't be done at a profit. Fifteen years ago we would have thought it was crazy to think we'd get natural gas out of something with a permeability measured around 200 nanodarcies (a crappy conventional reservoir is around 100 millidarcies; a great one is above one darcy). Now, thanks to technology and declining costs, they can create prolific natural gas reservoirs where it takes about $4/MMbtu to make money and that's hardly a historically high gas price.

Costs for things like oil shales will come down too and better, more efficient technology will come along (like they have for the tar sands and drilling off of the edge of the continental shelf). It's inevitable. As long as costs come down low enough so that exploration companies can make a profit, they'll try.

Even if costs were 100% energy, if you can use a cheap form of energy (like gas) to create something more expensive (like oil) and the costs are less than what you plan on selling that oil for, then that oil is going to be made and sold regardless of how much energy is expended. Return on energy is meaningless in the business world. I know it's wasteful. We could probably do better with natural-gas powered cars than generating dirty-oil to fuel gasoline-powered cars. I'd like that. And that's another technology hurdle for you: until somebody manages to throw together a network of natural-gas fueling stations where natural-gas powered cars can fuel up and they can make a profit, we won't be able to take advantage of the cheaper, cleaner, abundant energy source.

Technology, technology, technology.